Buy low, sell high. This four-word phrase is the only thing you need to know to invest successfully. Why, then, is something so simple as buying low and selling high such a difficult skill to be successful at? The answer is that we all have emotions that drive our investment decisions. I recently read a book called Same as Ever by Morgan Housel, the author of the popular book Psychology of Money. In the book, he explains timeless lessons about money, life, storytelling, ambition, and satisfaction. Below are three lessons I learned from the book, explaining how it ties into the difficulty of being a successful investor.

The grass is always greener on the side that’s fertilized with bullsh*t.

I’ve always heard the phrase “the grass always seems greener on the other side,” but never Morgan Housel’s version, which I like much better. One of the biggest reasons investors fail is because they become victims of false hopes and lies about investment ideas that will make them rich quickly. Many people fall into this trap because they hear about big winning trades or hot stock tips from a trusted friend or family member (or, even worse, their stockbroker) and want to be a part of the potential fortune it could bring. Most of the time, what you hear is bullsh*t (as Morgan puts it), and the “get rich quick” scheme ends up failing. Additionally, people will never tell you about their losing trades and only share their big winners, so you never know if they made money.

Another reason it’s easy to be a victim of this is the social aspect. No one at your neighbor’s BBQ is interested to hear your portfolio is invested in funds and instead talk about the individual stocks or penny stocks they own that will make them millions. Having the discipline to block out the external noise will increase your odds of success tremendously.

Saying “I’m in it for the long run” is a bit like standing at the base of Mount Everest, pointing to the top and saying, “That’s where I’m heading.” Well, that’s nice; now, here comes the rest.

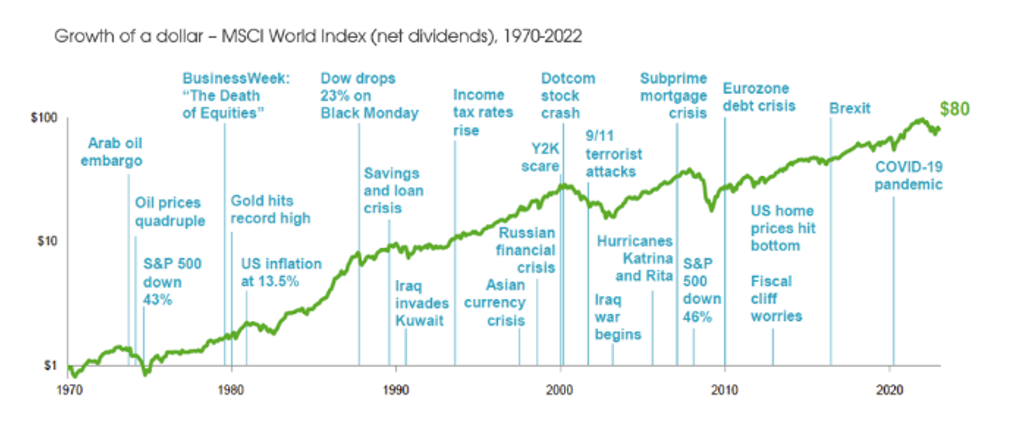

Investing for the long term is easy to follow when everything is going great but much more challenging when there is uncertainty. The market does not like uncertainty, so when a catastrophic event occurs like a war, pandemic, or inflation scare, the market tends to drop, causing fear in investors to go to cash and sell out of their investments. As investors, however, we know that throughout history, there have been many catastrophic events, and the market has always recovered, as shown below

We also know we can expect more events in the future, so why does fear still arise if we know recessions, wars, etc., are part of life and we can expect them? The reason is because of change. As things change, our perception changes. This is especially true when a change happens quickly. Morgan Housel explains in his book, “We are very good at predicting the future, except for the surprises – which tend to be all that matter.”

There are no points awarded for difficulty.

There is a misconception that complexity over simplicity is always better and will return higher results. I see where this comes from because when things seem too simple, they come off as poorly thought out and too easy. The fact is, however, simple is usually better, especially when it comes to investing. Think of your portfolio as a bar of soap. The more you touch it, the smaller it becomes.

The last quote from the book I will leave you with is from Mark Twain. He said, “Kids provide the most interesting information, for they tell all they know, and then they stop.” Adults tend to lose this skill. Or they learn a new skill: how to dazzle with nonsense.

The next time you think investing is as easy as buying low and selling high, remember that human emotions and external influences play a massive part in investing. This is why working with an independent, objective advisor can increase your odds of success due to the unbiased opinion and emotional detachment they bring to the table with your investments.

Joey Casolaro is a Certified Financial Planner ™ and can be reached at highlandplanning.com